Off Moneycrashers , Because of the Amy Livingston –

Depending on the 2016 National Financial Really-Being Survey held by the User Economic Cover Bureau, more than 40% away from American grownups have trouble and then make ends up see. It’s one to reasoning pay day loan try like large company within country. They claim an easy and quick cure for wave yourself over until your following paycheck. In the long term, they only create your situation even worse by the addition of a whopping notice commission to your other expenses.

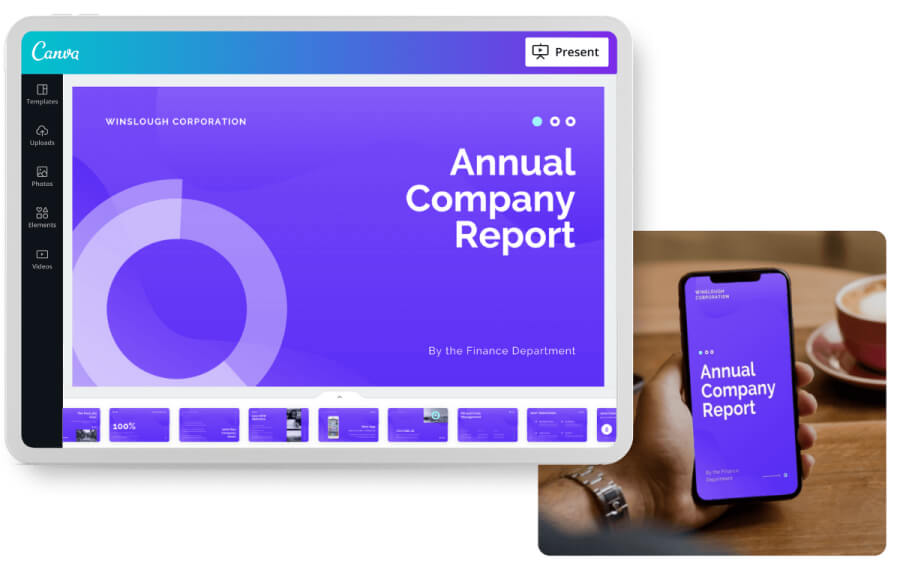

Through today’s technology, there clearly was the solution. Multiple well-known individual financing software help you create they in one pay check to another by providing your accessibility the income a few days early. This way, if it’s the midst of new few days as well as your automobile electric battery merely passed away, you can buy the bucks to afford fix without having to pay large attention and costs.

Exactly how Wage advance Programs Performs

Commercially, this service membership this type of programs give isn’t really that loan; it is an income get better. This means, it’s a way to get paid a little very early to the really works you’ve already did.

A pay day loan application will pay you for some of performs you already done this day, although their income has been a few days out. Brand new application transfers, state, $100 on the family savings, and if your upcoming salary arrives, the software takes $a hundred right from it to cover the costs.

It is the same manner a payday loan really works however with you to important distinction: There isn’t any appeal. When you discover your paycheck, all of that comes out of it ‘s the $a hundred you truly gotten, in place of an additional $15 or maybe more during the notice. The software secure their suppliers cash in different most other means, including tips and you can monthly charge. Continue reading “ten Finest Salary Get better Programs so you can Get to Pay-day”