These are generally loans for people earning some, most or their money from Centrelink pros. They could be also called Pensioner debts , impairment earnings financing , Carer financial loans , JobSeeker debts , smooth funds debts for Centrelink . A Centrelink financing simply financing device which can be used by anyone utilizing Centrelink means.

When you do get Centrelink advantages, it’s adviseable to check your ability to qualify for a Centrelink Advance financing and other national Centrelink assistance before you apply for example of our financing.

At funds Direct, we ensure that it it is an easy task to provide cash more quickly

We become you set-up as an innovative new earnings Direct user with a 100percent on line software process, and a brief onboarding call. Once youre an associate you are really when you look at the Express way, just login thereby applying for your upcoming mortgage 24?7 within a few minutes.

We generate our very own smaller Centrelink financing repayments affordable, in order to pay their tiny mortgage down within 2-6 months.

With this 100per cent on the web loan procedure, we have you cash quickly when you need it. With many people we could convert the amount of money your bank account in a minute.

Debts for People on Centrelink Benefits

We’ve tailored debts for those on Centrelink. We could offer financial loans from $200 to $2,000 for individuals on Centrelink parents Tax the and B, Jobseeker assistance, Carers money, Disability earnings, youthfulness Allowance plus.

We are able to accept financing in line with the income benefits you get, and always search Centrelink Support possibilities prior to taking a loan, in order to enhance your individual every month resources.

Loan Monthly Payments for individuals on Centrelink?

With your loans, we always have affordable monthly payments. Our company is liable loan providers , and then we want you as an accountable borrower.

Unlike common payday loans that want a brief repayment duration, with bigger repayments, we make your financing phrase much longer, up to 6 months. But we want one to close-out your loan earlier, so you can get back into a standard spending budget.

Generating mortgage try inexpensive if you are really on Centrelink benefits

If a lot more than 50% of the money try from Centrelink importance, well make sure that your mortgage repayments commonly higher then 20% (1/5) of your Centrelink earnings. This can help make fully sure your repayments were workable.

You are able to shell out the loan out anytime and you will reduce monthly charge, and we will maybe not recharge further. Should you decide skip a payment you will end up energized a missed repayment cost.

Borrow exactly what you will need, keeping they inexpensive in your Centrelink perks

With funds Direct, we anticipate all of our visitors which will make a unique financing if in need. You can use you, so simply acquire the thing you need. Dont overextend your self because youre not sure if you’re able to become earnings funds later on. Its easy, simply get on your hard earned money drive levels, and ask for a loan. For those who have close payment background with our team, there will not be problematic. We could be your book for a rainy time specifically if you dont bring a credit card or overdraft center.

?

Loans to have your credit in form.

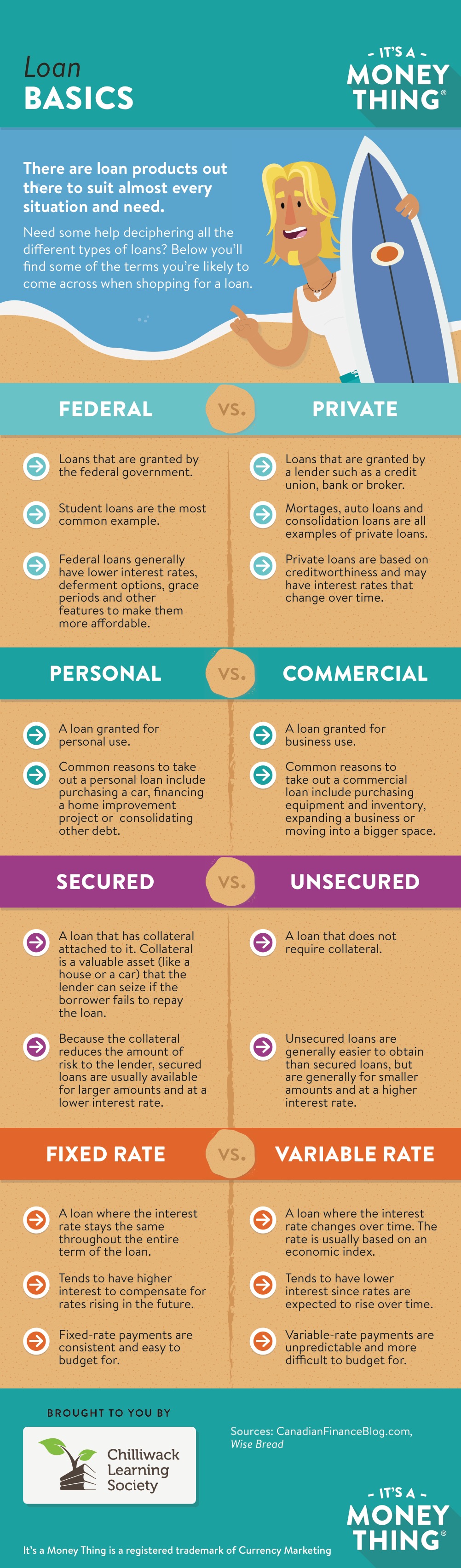

Good credit may be worth the time and effort! It can imply access to low-cost site hyperlink financing for your car or residence, the opportunity to hire a condo, rent a car, and on occasion even land a unique work.

Get the credit fit with 1 of 2 big STCU tools that create your credit score rating, generate economy, and prevent payday advance loan alongside monetary traps.

Credit Fit Mortgage.

Create credit rating or perhaps to restore your credit score. How it functions:

- Apply at STCU to acquire from $1,000 to $2,500.

- If authorized, a dividend-earning profile try opened to house those resources.

- For 12 to two years, you create regular monthly premiums. (for instance, a month-to-month fees on a 12-month, $1,000 loan is about $86.)

- When your loan stability was paid-in complete, the funds and the returns gained throughout the label of one’s loan! tend to be revealed to you.

Just like you making payments, we report your activity to national credit reporting agencies that create credit scores employed by banking institutions, landlords, insurance companies, employers, among others you may possibly contact someday. You establish an optimistic credit history and much better credit score, helping you to be eligible for bank cards and debts at a far better rates, or to rent out a flat, land a work, and other options.

Start building their credit nowadays. Consult any STCU department area or contact us to apply for your own credit score rating suit financing!

Resources Match Mortgage.

Require cash fast to support spending budget shortfall? An STCU funds suit mortgage escapes the horrible cash advance cycle!

Spending budget healthy mortgage is fantastic for customers that an unhealthy credit rating or financial obligation which may be keeping you from being qualified for common financing. In addition, it makes it possible to end a cycle of paying down expensive pay day loans, concept financing, and overdraft costs which make it hard to become in advance.

- To meet the requirements, you need to be an STCU representative in great standing for at least ninety days, and have now a working verifying or family savings that gets payroll deposits.

- Apply for a $500 to $2,000 mortgage. (A $20 application charge is needed.*)

- If authorized, you receive $250 to $1,000 in profit, with a matching levels frozen in a regular STCU bank account until your finances Fit financing is paid back.

- We provide you with six to two years to repay the loan not all in the past like a quick payday loan will require.

- Your preliminary mortgage rates is higher, but drops significantly when your mortgage stability are paid off to the amount frozen in your bank account.

- So when the mortgage is repaid, resources in your family savings plus any accumulated returns that accrued include launched for you.

Bring a fresh beginning these days with a Budget Fit Loan. Consult any STCU branch location or contact us to try to get your financial budget healthy mortgage!

Financing payment possibilities.

We offer a few techniques to spend the STCU unsecured loan.