Buyers advocates have traditionally warned you to definitely payday loan providers on purpose make an enthusiastic work to attract consumers toward a costly and you will unbearable age of financial obligation.

The consumer Economic Shelter Agency accused the leading payday loans merchant, Ace money Expre, of using a great amount of illegal solutions to preure clients having overdue money to acquire a great deal more to pay for him or her down.

The fresh new allegations against Expert marked the full time which is very first bureau officials accused a payday lender out of on purpose driving anyone straight into an obligations period.

Adept, with step one,500 store metropolises inside Ca and you will 35 most other states, agreed to spend ten dollars million to keep how it is actually, in the place of admitting otherwise doubting wrongdoing.

The fresh new Irving, Colorado, company iued a declaration detailing it cooperated with the bureau’s research for 2 ages so the most their employees’ phone calls so you’re able to members complied with collection advice.

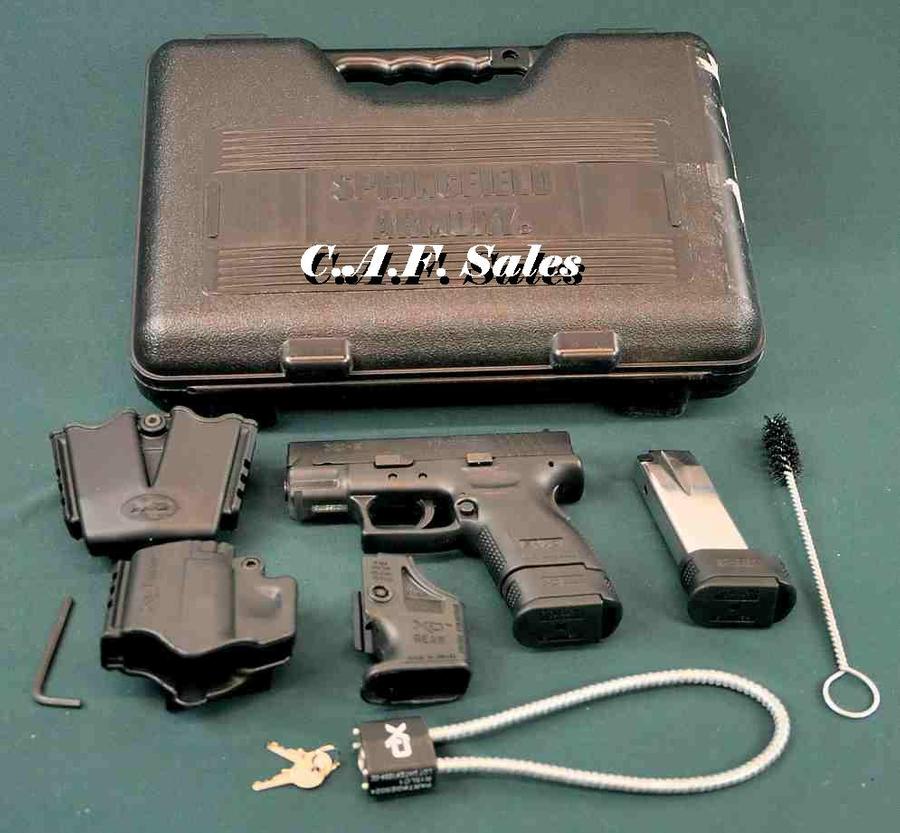

The new bureau’s lookup contributed to a graphic payday loans OK regarding an adept studies guidelines appearing the latest game mortgage proce just exactly how consumers was getting contacted to acquire the latest loans once failing woefully to pay right back dated some one.

“Ace used incorrect threats, intimidation and haraing phone calls to help you bully pay-day consumers with the an occasion away from obligations,” bureau Manager Richard Cordray said. “This society off coercion strained scores of dollars out of cash-strapped customers that selection which can be few challenge.

New agency, developed by the fresh 2010 change that’s financial, has actually made an effort to separated lower for the pay-day capital abuses and you can it is given whether the latest federal advice are needed.

Payday advances, very very a lot of time an installation working-cla and reasonable-money areas, became well-accepted throughout the Great Receion and its wake because dollars-secured consumers appeared to possess a remedy that’s short tide him or her more up until the second income.

From the 20,600 pay day places acro the world create $38.5 million this financing every year, according to the Society Economic Properties A keen. regarding The usa, a corporate exchange class.

The money which might be small-identity normally $350, was cash advance into a salary. Brand new money usually are for two weeks which have an appartment 15% pricing otherwise an appeal you to definitely really does voice also bad n’t.

But expenses can increase rapidly if the mortgage is most certainly not smaller as well as the borrower needs to simply just just pull away another mortgage to settle first one to.

This new Ace situation provides stark proof of the new industry’s busine model and might cause tougher laws and regulations from consumer bureau, said Nick Bourke, manager regarding your little Money Financing promotion from the Pew Charity Trusts.

A pay day loan is marketed while the a short-label short-term boost, Bourke said. you most people need 1 / 2 of the 1 year to pay for mortgage straight back.

The money progress busine design do break apart if customers only attempted they for two otherwise 3 days at the same time, Bourke stated.

The brand new Expert degree tips guide artwork offered an explicit picture to the loans pitfall, told you Mike Calhoun, president associated with the Cardiovascular system to possess Responsible Lending.

The fresh allegations facing Ace arrived shortly after a study set off by an examination which is routine away from company’s businesses inside the bureau’s oversight.

The latest agency told you their browse discovered that Ace’s for the-home and you will financial obligation that is third-party made use of unlawful methods, such haraing phone calls and you will not the case dangers in order to statement www very pawn america com approved consumers in order to credit history teams, to attempt to push these to score new money to help you accept the outdated some one.

Ace had been relentlely overzealous with its search for delinquent members,” Cordray told you.

From inside the a statement, Adept said they leased a specialist that is exterior receive 96percent regarding your organization’s calls so you’re able to website subscribers fulfilled relevant range standards. The firm as well expected the idea it attracted customers for the to help you a period of financial obligation.

The firm said an analysis of its information away from located 99.5percent away from readers which have money in range for over ninety days wouldn’t create brand new loans which have Expert within 2 days from paying off the present of those. And you can 99.1percent off readers would not lose a loan that is the fresh new fourteen days out of settling newest financing, it said.

Still, Adept stated, it has got removed procedures as the 2011 to cease violations, together with broadening its tabs on collection phone calls and you can closing and make accessibility an enthusiastic unnamed 3rd-people collection company your agency had concerns about.

This new bureau told you within the settlement, Expert will hire a company to contact eligible people and you can iue refunds.

Buyers advocates want to the latest bureau tend to write federal guidelines requiring pay check loan providers to ascertain a good customer’s capability to pay off before iuing finance.

“Certainly there is a time for the everyone’s life after they ela Finance companies, elderly policy the recommendations to own People Partnership. But i recommend users to think much time and hard on if they need the loan.

They should earliest move to loved ones, relatives or even their chapel — “anything short of a pay day lender,” she said once they would need money.